Intro: Finance is the basic need and a necessity for the business to survive in a dynamic environment. It is a lifeline to every business running across the globe. Finance provides the business a master key to get into all functional areas and act as a doctor which provides the insights and the present condition with sources to improve it. Finance department plays a major role in an organization. It provides funds to all other departments to carry out their operations helping the business to grow. It is the function of the finance department to take care of the allocation of the resources with the sufficient return on investment by identifying all the factors influencing the numbers of the department. To coordinate all the activities, Financial Management takes charge for the planning, organizing and controlling the financial activities of an organization. Every department wants to utilize the resources to its full potential with a set of given targets to improve on. Irrespective of the size, nature of an organization, financial management is used in every organization.

Evolution of Indian Taxation System-

The first tax which was introduced in India was ‘Income Tax’ by Sir James Wilson to cover the losses or to run the military Mutiny of 1857. After some decades, the new income tax with modification in the structure was passed and it was replaced or overcome by a new act passed in 1922. This modified act sustained till 1961 with some additions to the amendments. The Income tax of 1961 was passed in reference to the Ministry of Law with various provisions in the act where it was imposed to whole of India including Jammu and Kashmir which was brought into force by April,1962. In the report of Shri Amaresh baghchi, he suggested that the successful introduction of Value added tax in Indian Taxation system will help the economy to build it for the implementation of the Goods and Services tax in India. Later in 2009 Shri Pranab Mukherjee, the new Finance Minister announced the basic structure of the GST which is to be implemented on 1 April,2010, The bill was cleared from Lok Sabha and was sent to the GST council as congress also agreed with the BJP government to amend the bill with the specific modifications in the provisions of the tax structure. (Singh, 2017). Finally, the Goods and Services tax regime was rolled out on July,2017 with four GST slabs:

Loopholes in the Indirect tax structure

Cascading effect of taxation comes into the scenario when the indirect tax structure is there, it increases the prices of goods and services as the tax is levied on each and every level of supply chain. As certain goods and services like oil and gas, mining, agriculture, wholesale and retail trade, real estate are kept out of the CENVAT and the central sales tax levied. The traders who are dealing in these goods are not allowed to claim input tax credit which increases the production cost or the rendered cost. Complexity always come along with the Indirect tax structure as country to country, the tax levied on the goods and services vary with respect to the sector. The central and state system remains complex as they always run on disputes in the court leading to the increased cost of court judgements.

Goods and Services Tax- The Goods and services Tax is a consumption based tax on the supplies of goods and services. The tax is levied from the starting of the supply chain to the end consumer i.e. from the manufacturers to the ultimate consumer. Accordingly, the goods and services will be taxed when the value addition takes place and is levied fully to the consumer. GSTN refers to The Goods and Services Tax Network is a body who is assigned the responsibility of the operations of the GST in the country when it comes to catering the needs of all the problems and issues raised. The functions of The Goods and services Network includes:

Indian Auto Component Industry- The Indian Automobile Industry has always been a thrust to the Indian Economy by contributing around 7% of the country’s Gross Domestic Product. From the time of liberalization, automobile industry made a huge impact on the auto ancillary industry as foreign companies started to join hands with Indian companies to capture market by giving it a boost in all aspects of growing technology, low labour cost, high quality components and the human skills needed in the sector. India has been seen as a major hub for investment because of factors like infrastructural development, stable government, large domestic market and the consumer’s tendency to spend on newly introduced products and services. The Auto-ancillary industry contributes around 2.3% to the India’s GDP and 1.5 million people have been employed by the industry. The industry has been expanded by 18.3% to the level of US$51.2 billion in FY 2017-18.The rapid development of auto ancillaries has been possible only because of the automotive industry which is a key driver for the growth in India. Foreign automobile companies have started investing in India to create smart R&D departments for innovations in technology and in manufacturing area. The consumers in India has responded to the automobile manufacturers by focusing only on small car models. Thereby, automobile manufacturers have started producing small cars models to supply the needed consumer with each and every specification in the car with a low cost. Due to this, India has been known for its Largest Small car consumer globally. For example, Maruti Suzuki took the early mover advantage of identifying the growing small car consumption in India, that is why today Maruti Suzuki is known for its largest car portfolio in small car segment providing Indian Consumers with every option of investing in a car in all price range with the best in class specifications provided in a car when compared to other automobile manufacturers in India.

(K.M, 2010) In his article concluded that GST has come into force because of the benefits that it delivers to the whole economy. It is a uniform tax rates across the country i.e. India which ensures the compliance to be improved by lowering the tax rate. The officials have confirmed that in the long run, the commodity prices will lower down to give advantage to the ultimate consumers which will enable the domestic producers to easily compete with the International manufacturers. In indirect tax regime, the auto ancillary industry was paying the tax ranging from 18% - 20 % and 30-45% in automobile industry whereas if we compare it with the GST rate i.e. 18% for auto component industry and 28% for the automobile segment. The difference of the rates can strengthen the economy as the auto sector will see a big boom in coming years. (J.S, 2010) discussed that The Globalization has enhanced the trade in India with the special effect in automobile and auto components in trading commodities. Auto component industry (accessories) has always been a spine of the whole of the automobile industry as it is able to deliver the quality because of the availability of resources like labour, technology, cost of production etc. Apart from these factors, the auto component industry face challenges like research and development as they spend less on the department, limited knowledge of the product development, poor supply chain in few markets because of lack of experience etc. The officials of the industry say that the hinderances or the challenges will be overcome by the way of modification in the individual companies as well as the policies introduced by the government as recently government is planning to implement GST so it might change the condition of the industry as in how it operates presently.(Vasanthagopal, April 2011) has discussed that Goods and services Tax is a consumption based tax where the tax burden is finally implied on the consumer and not on the dealers. Dealers also make a part of the supply chain but they have got a benefit of Input Tax credit of this time where they can claim the input tax from the government in all of the automobile components. If we see the state level condition, the taxes like CENVAT and services tax will be removed to get subsumed into a single tax structure of GST. This will lower down the overall tax burden by increasing the tax revenue collection. The success of GST can be seen in more than 140 countries where the implementation of the tax structure can now be seen in Asia Pacific region too. (Garg, 2014) has emphasized on Indirect tax regime where Value added tax which is at the state and the central level is considered as an important step towards the development of tax structure in India. But after the display of goods and services tax, it is indeed a unique tax structure where all the other taxes are subsumed under one. The main objective that GST adhere to is to removal of cascading effect which in turn increases the prices of goods and services at every stage in the supply chain becoming burden on dealers as well as consumers. It also helps in reducing the transaction costs, multiplicity of taxes, reduces the tax burden and the corruption too. Government of India so far has taken a crucial step to achieve a milestone by becoming a developed country from a developing country.(K. Neelavathi, 2016) has forced on the fact that The automobile sector has always been an engine to the India’s GDP which powers and drives, it is because of the policies that has been implemented time to time by the government but for some period of time, government increases taxes on the sector which becomes threat to its own sector and country reducing the growth in overall. When it is been identified by the officials, another option which is given is to increase the employment to increase social welfare which will itself increase the standard of living of the people. In a report, it was clarified that 13 employees can produce a truck, 6 can produce a car, 4 can produce a three- wheeler vehicle and 2 can produce a two-wheeler. So, If the potential of every employee is utilized, the Indian auto sector can grow at a huge rate. These calculations come into the wall when GST took charge as it was necessary to look after each and every detail of the industry to improve it to the extent where the full potential can be utilized whereas the fall in tax rates and ease in the return submission has lower down the general cost which the producers were facing earlier. (Saurabh Gupta, May, 2017) has concluded that In India, the consumption of goods and services has increased and is growing at a fast pace as consumers have increased their spending in case of standard of living. With this consumption and spending kept in mind, a simplified and a comprehensive taxation system is required to run India which can be possible only by implementing the new tax structure i.e. The goods and services tax structure in India. It will subsume all the taxes and will contribute to the higher output in long run by lowering down the tax rates with high employment rates. The Indirect tax system has many loopholes of misallocation of resources within the country provinces, uneven tracking of sale of goods and services which can be overcome by implementing the flawless ‘GST’. (Anil Kumar Bhuyan, December, 2017) has concluded that Taxation always affects the economy irrespective of the country’s strong GDP. The new taxation system of The Goods and Services tax will be a transforming step which will affect the industries in a positive way including manufacturing, exports, employment growth rate and negative effect on the service sector as the proposed GST rates are higher than the current tax rates in the indirect tax structure. The implementation will take time because of the conflict between central and the state government in the amendments. In future, whenever the GST is implemented, it will be the boon for the Indian economy in terms of growth as it will ultimately benefit the consumer and the manufacturing industry. (GOYAL, June,2017) has discussed that With the upcoming tax regime, the Goods and services tax, the auto sector is thrilled with the demand by the consumers. Going through the current tax structure, the sale of automobile includes taxes like Excise duty, VAT, Road Tax, Infrastructure cess and Tax collected at source (TCS). Now, focusing on the benefits that the industry will be inheriting from GST, if the proposed rate of 18- 20% are approved, the prices of vehicles will be lowered down by 10-18% leading to lower down tax burden on the consumers. Input Tax credit will be paid on all components in the condition of the registered dealer with GST identification number. It will stimulate the growth of foreign direct investment in India because of less complexities and regulations. The authors were able to find that the overall economic activity will be increased with the increase in the market demand of the vehicles, thus accelerating the growth of automobile and ancillary industry. (Moneycontrol and KDK software, 2017) has discussed about the upcoming effective rates in GST, industry experts are saying that the 18% rate under the new regime may boost up the auto ancillary industry as compared to the 28% -30% in present. In present market, the industry is able to sustain and grow with the benefits it is reaping from globalization of auto industry, so the new tax system will help auto original equipment manufacturers (OEM’s) to expand parallelly with automobile industry i.e mainly of auto manufacturers as said by the officials of KDK software. Also, majority of the auto original equipment manufacturers (OEM’s) were to set up their units near the automobile manufacturers to avoid the VAT credit chain as it took longer period of time to get credited to the supplier’s account. Now, in new GST structure, there is no need to set up the unit near to the automobile manufacturers as the input tax credit claim will be available through SGST and IGST to them. They will be able to set up the units in lower investment cost and can utilize the working capital more efficiently. With all of these benefits, GST will make an impact on the factors of pricing of vehicles, establishment costs, profitability to dealers resulting in providing overall economic efficiency to auto ancillary industry. (Bhattacharya, November 2017) has emphasized on the Goods and services tax Bill which also known as The constitution (One hundred and Twenty -second Amendment) Bill ,2014 is supposed to be implemented on 1 April,2017. According to a report from National Council of Applied Economic Research, after implementation of GST, the exports will increase from 3.2% to 6.3%, financial development by 0.9% to 1.7%. Each businessman registered with GST council will be given a separate GSTIN for trade and the claim of input tax credit. With all of these salient features of GST, we can expect a faster growth of our economy by conquering all the challenges that council is facing as to resolve all the issues that stakeholders or people might have after its implementation. (Dhingra, n.d.) has concluded that the automobile sector, GST has been a positive ray of light after a period of time. It is a single window tax system where officials of the company don’t have to walk in various offices of the government to pay taxes which itself decreases the operating cost and increases the efficiency by utilizing the labor in other operations. The various taxes like Excise duty, sales tax, VAT, Cess, Service tax etc. have been subsumed under one regime of GST making it convenient for every business person. GST is a tax based on consumption of goods and services not on origin based, so the revenue collected will be separated on the basis of the categories of tax i.e. SGST and CGST for state and central, IGST to central, therefore the states will be benefitting more because manufacturers are more than the consumers in majority of the states, therefore states will enjoy the revenue.

3-Research Methodology –

The Indian Automobile Industry has always contributed towards the India with respect to economic as well as social welfare. With time policies and tax regulations were implemented in favor of domestic producers so that domestically the sector can grow and establish a benchmark. In recent time, The Goods and Services tax (GST) was implemented which changed the India’s tax structure by making it easy and convenient for the tax payers. Taxation in India has always been a problem when it comes to the distribution of funds between the states and the central government as well as the tax rates which are applicable to certain goods with the judicial judgements going in the court from years. In the Indirect Tax structure, majority of the auto components were not applicable for the input tax credit claim which increased the production cost for the auto equipment manufacturers leading to less profitability. Also, auto equipment manufacturers were required to set up the OEM’s unit near the auto mobile industry or near to the market to avoid the VAT credit chain leading to increased prices of goods. After implementation, major changes could be seen in the auto sector in terms of upward and downward trend in the auto ancillary industry which has thrown a need to get the cause of the problem by getting the responses from the officials working in auto ancillaries. Following are the objectives of the study.

Population and Sampling Technique

The sampling technique used in the present research study is single stage cluster sampling. In this, a sample frame is divided into clusters i.e. from the officials of the auto-ancillaries in automobile industry, finance and the top management officials were taken as selected clusters which were used for data analysis. For data collection, primary and secondary data was collected where primary data was collected with the help of questionnaire where company centric approach was used in which 42 manufacturers in Delhi-NCR were chosen to conduct the study and secondary data through sources like GST portals, newspapers, research articles, magazines and other Tax consultancy websites. The secondary data is purely mined from the authorized research websites of the Government of India in terms of the provisions of the act that are used in the study, Indian Public Finance Statistics (IPFS), reports from the central board for Direct Tax (CBDT), the history of Indian tax with income tax of 1961. After Evaluating the research tools as per the standard procedures, the analysis of the collected data has been conducted by using various tools in Statistical Package for Social Sciences (SPSS) like reliability test to check whether the data collected through questionnaire is reliable enough to conduct/run the technical test. Cronbach’s alpha which is also known as Reliability test is used to measure the consistency of the data. The questions used for the tool/test should be in the form of Likert scale or else the test will be Reliability Analysis.

4- Results and discussion –

Table 1- Reliability Test Results

| Cronbach's Alpha | No. of Items |

| .752 | 14 |

The reliability test was run on 14 variables(Items) with 42 responses collected from the officials of the auto original equipment manufacturers according to the case processing summary in order to check the validity. This is a measure of dimensionality as to know how closely a set of questions are related. According to the reliability analysis, Cronbach’s Alpha value = 0.752>0.7(Accepted value)

Hence, the data is reliable with the 14 variables taken under consideration

Table 2- Correlation Analysis- Correlation Test Result (Positive Input Tax Credit and rate Outsource Production)

| Positive Input Tax Credit | rate outsource production | ||

| Positive Input Tax Credit | Pearson Correlation Sig. (2-tailed) N |

1 25 |

-.419* .037 25 |

| rate outsource Production | Pearson Correlation Sig. (2-tailed) N |

-.419* .037 25 |

1 42 |

H0 – There is no significant correlation between Positive input Tax credit and rate outsource productio

H1- There is a significant correlation between Positive Input tax credit and rate outsource production

A Pearson correlation coefficient in the above table indicates that the relationship between the Positive input credit i.e. the input tax credit claim has benefitted the OEM’s in the growth of their business and the rate outsource production i.e. the shortcomings in the Indirect Tax structure which led the government to replace it by The Goods and Services Tax in the need of helping the economy to grow. There is a moderate negative relationship between the two variables i.e. r = -0.419, n= 25, p= 0.037. The p value shows that the significance is 0.037 which is less than the 0.05 through which we can conclude that the alternative hypotheses is accepted. Moderate negative relationship between positive input tax credit and the rate outsource production implies the inverse relationship between two variables indicating that if one increase, the other decreases. It means that when the auto original equipment manufacturers/dealers starts receiving input tax credit claim faster and with efficiency, they will be able utilize that fund in other segments of the business with an additional usage in the operating expenses of the business , thus leading the outsource production or outsourcing the activities of the business to come down as all the activities will done under the manufacturing house to save the taxes. By this, the manufacturing business will be able to get long term advantage of the in house manufacturing.

Table 3- Correlation Test Results (Negative Multipolicies in Return Submission and Rate Cascading Effect

| Negative Multipolicies in return submission | rate cascading effect | ||

| Negative Multipolicies in return submission | Pearson Correlation Sig. (2-tailed) N |

1 17 |

-.156 .549 17 |

| rate cascading effect | Pearson Correlation Sig. (2-tailed) N |

-.156 .549 17 |

1 42 |

H0 – There is no significant correlation between negative Multipolicy in return submission and rate cascading effect

H1- There is a significant correlation between Negative multipolicy in return submission and rate cascading effect

A Pearson correlation coefficient in the above table indicates the relationship between the negative multipolicy in return submission i.e. auto equipment manufacturers found the impact of GST as negative on their business because of the multipolicy in return submission leading to the increased time and human capital and rate cascading effect i.e. the auto equipment manufacturers rated cascading effect as the shortcoming in the previous tax structure which led to the GST implementation. There is a weak negative relationship between two variables i.e. r = -0.156, n = 17, p = 0.549. Weak negative relationship between the negative multipolicy in return submission and rate cascading effect implies the inverse relationship which means that when the auto equipment manufacturers face the negative effect on the business because of the multipolicy related in filing return leading to more consumption of time and money, the cascading effect will not have a larger impact which simply means the double taxation system will be decreased because of the cross correction in the returns submission by the GST and Income Tax department.

H0 – There is no significant relationship between the variables impacting the auto original equipment manufacturers (OEM’s)

H1- There is a significant relationship between variables impacting the auto original equipment manufacturers (OEM’s).

Table 4- KMO Bartlett's Test Result KMO and Bartlett's test

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | .839 |

| Bartlett's Test of Approx. Chi-Square | 750.970 |

| Sphericity df | 136 |

| Sig. | .000 |

If KMO is greater than 0.5, the sample is considered as adequate The Kaiser-Meyer Olkin (KMO) measure of 0.839 which is larger than 0.5 shows the adequacy measurement of the proportion of variance among variables and also tells about the proportion of variance in the variables that might be caused due to various underlying factors implying we can proceed with the factor analysis. The chi-square value of Bartlett’s test of sphericity is 750.970 with 136 degree of freedom which is significant at 0.05 level of significance. Hence, factor analysis is considered to be an appropriate technique for the further analysis of data

Table 5- Total Variance Explained

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

| Total | % of Variance | Cumulative % | Total | % of Variance | Cumulative % | |

| 1 | 9.237 | 54.336 | 54.336 | 9.237 | 54.336 | 54.336 |

| 2 | 1.557 | 9.156 | 63.492 | 1.557 | 9.156 | 63.492 |

| 3 | 1.373 | 8.074 | 71.566 | 1.373 | 8.074 | 71.566 |

| 4 | 1.093 | 6.430 | 77.996 | 1.093 | 6.430 | 77.996 |

| 5 | 1.065 | 6.265 | 84.261 | 1.065 | 6.265 | 84.261 |

| 6 | .802 | 4.718 | 88.979 | |||

| 7 | .572 | 3.364 | 92.344 | |||

| 8 | .552 | 3.247 | 95.591 | |||

| 9 | .307 | 1.809 | 97.399 | |||

| 10 | .128 | .755 | 98.154 | |||

| 11 | .099 | .580 | 98.734 | |||

| 12 | .082 | .485 | 99.219 | |||

| 13 | .050 | .293 | 99.512 | |||

| 14 | .038 | .221 | 99.733 | |||

| 15 | .021 | .123 | 99.856 | |||

| 16 | .018 | .104 | 99.960 | |||

| 17 | .007 | .040 | 100.000 | |||

Extraction Method: Principal Component Analysis.

On the basis of varimax rotation of the Kaiser Normalisation, 5 factors have been extracted from the table. Each of the shown tables consists of all the variables that have factor rating greater than 0.5. % factors were extracted from the 17 variables used for the study. Those 4 extracted factors explained 84.261% of the variability the impact of GST on the auto original equipment Manufacturers (OEM’s). The above table shows the percentage of the variance i.e the first factor accounts for 54.336% of the variance, second factor accounts for 9.156% of the variance, third factor accounts for 8.074 % of the variance, fourth factor accounts for 6.430 % of the variance and the fifth factor accounts for 6.265% of the variance.

Table 6= Communalities

| Initial | Extraction | |

| Unit Specialization | 1.000 | .899 |

| Automobile Component | 1.000 | .556 |

| Impact of GST | 1.000 | .930 |

| Positive Input Tax Credit | 1.000 | .941 |

| Positive Operating Cost | 1.000 | .973 |

| Positive Reduction in slabs | 1.000 | .756 |

| Positive Economies of scale | 1.000 | .967 |

| Positive others | 1.000 | .816 |

| Negative Time consuming | 1.000 | .973 |

| Negative Increase in tax rate | 1.000 | .893 |

| Negative Multipolicies in return Submission | 1.000 | .967 |

| Negative others | 1.000 | .948 |

| rate cascading effect | 1.000 | .833 |

| rate outsource production | 1.000 | .713 |

| rate multiplicity of taxes | 1.000 | .809 |

| rate multiplicity of rates | 1.000 | .698 |

| rate others | 1.000 | .656 |

Extraction Method: Principal Component Analysis.

From the varimax rotation of the Kaiser normalisation, 7 factors have been extracted because of the same extracted value of two factors contributing to the results. With reference to the GST impact on auto component industry, extracted value of 0.973 or the 97.3 % of the variance associated with question 5 is common in nature. Time consuming with respect to the impact on auto component manufacturers implies that the time which is consumed in maintain the record of the GST returns and filing to the GST portal with required format as set by the Government. With reference to the table, extracted value of 0.973 or 97.3 % of the variance associated with question 9 is common in nature. Economies of scale means when level of production increases with the significant reduction in cost. With reference to the impact on auto component industry, manufacturers were able to achieve economies of scale after the implementation of GST leading to the overall growth of the business. Accordingly, the extracted value of 0.967 or 96.7 % of the variance associated with the question 7 is common in natur (Negative). Multipolicy in return submission means that auto component manufacturers found difficulties/ complications in the submission of the GST returns to the government which had a negative/stable effect on their businesses. Accordingly, the extracted value of 0.967 or 96.7 % of the variance associated with the question 11 is common in nature. Other factors includes the factors which had interfered the business growth after the implementation of The Goods and Services Tax. Accordingly, the extracted value of 0.948 or 94.8 % of the variance associated with the question 12 is common in nature. Impact of GST on the auto original equipment manufacturers was identified to be positive with the help of the descriptive statistics as 61.9% of the manufacturers had responded with the positive with respect to the impact of GST on their business. The focus of the study was to analyse the impact with the associated factors. Accordingly, the extracted value of 0.930 or 93 % of the variance associated with question 3 is common in nature.

Descriptive Analysis

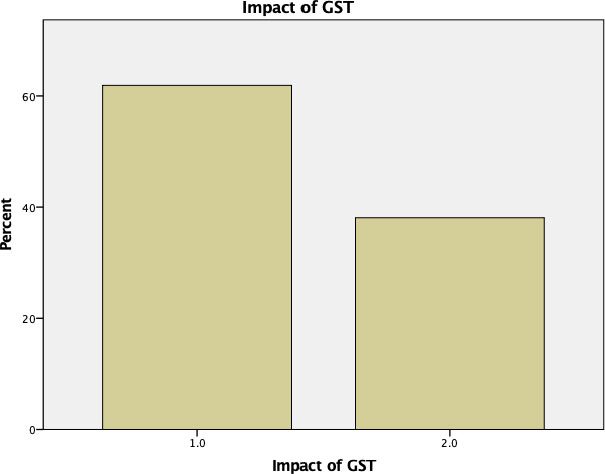

Figure 1- Frequency Distribution Table (Impact of GST) Impact of GST

From the statistics shown in above graph, it can be concluded that the 61.9 % of the auto original equipment manufacturers found the GST implementation in a positive way as it helped the business to achieve economies of scale and an increment in the revenue by increasing the requirement for the spare parts and also because of the relief of input tax credit claim to the registered manufacturers with GST identification number which further helped as operating capital towards the business. However, 38.1% of the manufacturers found the GST implementation as same as the indirect tax structure because of the negative/Stable effect on their business with regard to their stakeholders. Through the data collected, it was identified that manufacturers found the GST return submission as time consuming which affected the human capital and also 40% of the auto components are under 28% slab and also a low input tax claim which has made the operating cost of the business to rise ultimately affecting the auto component business growth.

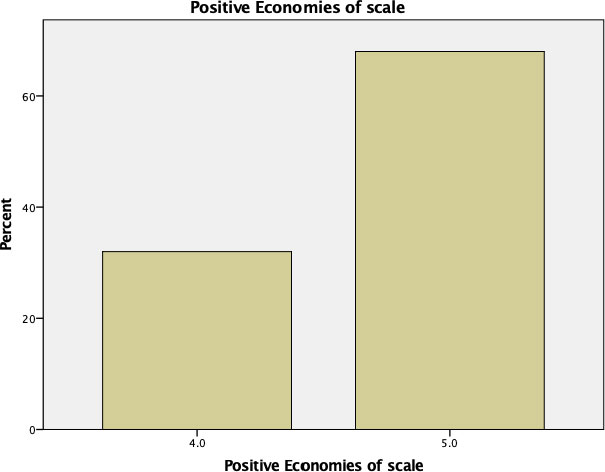

Figure 2-Frequency Distribution (Positive Economies of scale) Positive Economies of scale

From the statistics shown in above table and graph, it can be concluded that 68% of the manufacturers found the ‘Economies of scale’ factor as positive which helped in the growth of the business. It means that with the implementation of GST structure, manufacturers were able to increase their level of production at the same time reducing the cost ultimately achieving the ‘economies of scale’. Also, the production cost has come down due to the utilisation of available resources like human capital, labour, land etc which in turn has supported the auto component industry to grow at a higher rate.

Figure 3 - Bar Chart (Positive Operating Cost)

From the statistics shown in above graph and table, it can be concluded that 72% of the auto component manufacturers have rated ‘Operating cost’ factor as 5 which implies that operating helped in the growth of the business. It means that the goods and services tax has made the operating cost to rise because of the timely input tax credit claim and no physical effort needed to file a return which can be possible through online GST portal. In the previous tax structure, the employees need to roam to the various government offices to submit the tax return to the government which increases the physical efforts of the employees and the consumption of time simultaneously.

Figure 4- Negative Increase in Tax Rate

From the above table and graph, it can be concluded that 76.5 % manufacturers have rated the ‘Increase in tax rate’ factor as 1 which further implies to be ‘not at all influential factor’ in influencing the business operations to be negative/stable. It means that the tax rates have been same or equal as compared to the previous indirect tax structure including excise duty and VAT/CST i.e. 18%. -20%. In the beginning of the GST implementation, the tax rates for the auto components were 28% which had a large impact on the manufacturing industries sales as consumers found the components very expensive and also the automobile prices also increased at that period of 6 months. After 6 months, government shifted the rate to 18% after finding the decline in the revenue of the automobile manufacturers in the quarterly returns.

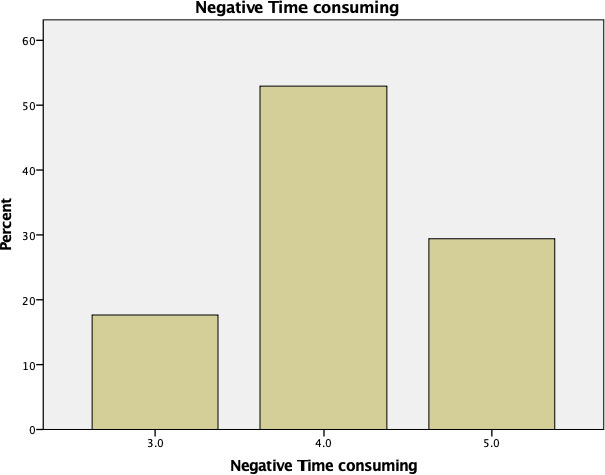

Figure 5- Negative Time Consuming

From the statistics shown in above table and graph, it can be concluded that 52.9 % manufacturers have rated ‘Time consuming’ factor as 4 which further implies to be ‘very influential’ factor in influencing the business operations to remain negative/stable. It implies that manufacturers need to spend more time to maintain the record and file returns to the GST portal which affected their business to the very much extent. The GST returns like GSTR 2 and 3 (other than 3B) needs to be maintained in the records of the company as there is no compulsion from the government side to file the same, but whenever the demand is raised to show these returns, it becomes mandatory for the company to show or file the return to the GST portal.

From the statistics shown in above table and graph, it can be concluded that 41% of the auto component manufacturers have rated ‘Multipolicy in return submission’ factor as 4 and 5 which act as a negative side of the GST implementation. It means that manufacturers found complications while submitting in the GST return as there are many policies in terms of rules and regulations that is to be completed before submitting the required GST returns to the government. The company has to regularly update the accounts person about the trade and transactions so that he/she does not lose track of the regular updates in the trend.

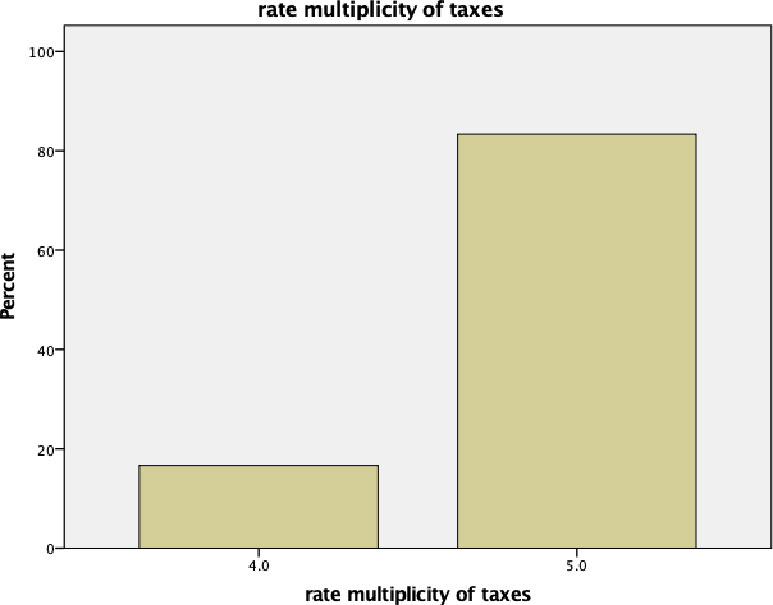

Figure 6 -Rate Multiplicity of Taxes

From the statistics shown in above table and graph, it can be concluded that 83% of the manufacturers have rated ‘Multiplicity of taxes’ factor as 5 which implies to be the factor responsible for the shortcomings in the Indirect Tax structure. It means that in indirect tax regime, there were multiplicity of taxes or no of taxes like service tax, VAT, central sales tax, excise duty etc which made the manufacturer to go to the various tax department to submit the tax returns.

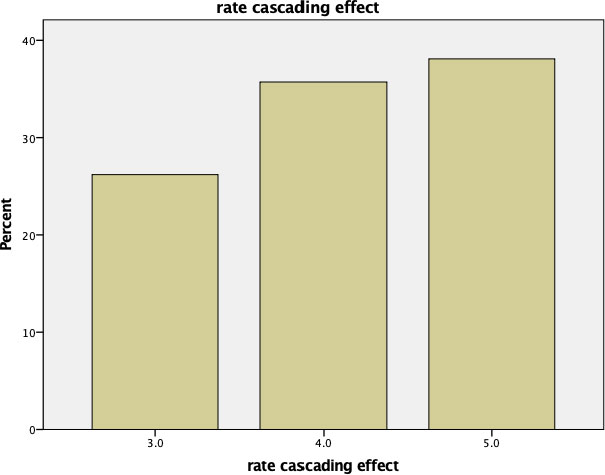

Figure 7 Bar Chart (Rate Cascading effect)

From the statistics shown in above table and graph, it can be concluded that auto component manufacturers have rated ‘cascading effect’ as one of the major shortcoming in the indirect tax structure where the degree of responses have been on an upward trend which can be seen through graph and through percentage in the table i.e. 26% in 3 rating, 35.7 % in 4 and 38.1% in 5 rating. It means that the double taxation placed a major shortcoming in the indirect taxes where the prices of goods increased at each and every level when the goods are supplied through supply chain of the auto component industry.

5-Conclusion and Suggestion -

Conclusion-

Goods and services Tax (GST) has been a buzzword among the people in the country before it was implemented as it was the major step taken by the government in altering the Tax Structure of country and making it a ‘One country, One Tax’. Though there have been many amendments which have taken place to alter the way it functions to make it feasible for the companies to file the returns. GST is a comprehensive, simplified tax structure which will enable the government to collect tax revenues ultimately supporting the infrastructural development and social welfare.

Automotive Industry has seen a positive impact after the implementation of The Good and Services Tax as some of the fluctuations had been there in the beginning of the months due to high tax rates but after the quarterly results from the industry, they were subject to be changed and shifted to the lower rates in the auto component industry from 28% to 18%. This change in tax rates occurred due to the quarterly results of the auto component industry that came after 3 months of the GST implementation. But in present also, not all auto components are under GST slab of 18%, round 40% of the components are still under the tax sab of 28% which should be changed or lower down to an extent which does not cause harm to the manufacturers business as well as to the government in terms of revenue collection. Over the decade, the production efficiency of the automotive industry has increased to an extent that the utilisation of the employees takes place. It is seen that 13 employees are needed to produce a truck, 6 employees can produce a 4 wheeler, 4 employees can produce a three wheeler and 2 can produce a two wheeler. With the advancement in the production techniques of the automotive industry, the production rate will fourfold in the decade because of the investments that the major companies are allocating towards the research and development. This department constitutes the mother for all of the industry as it gives birth to the every new technology that is implemented in the industry for the safe , efficient and reliable production. One of the innovation that the Auto component industry/Automotive industry will see in coming years is the efficiency in transportation of Goods. This means that the transportation techniques in the present operates through petroleum sources or through the fuel combustion techniques which leads to an increased cost of fuel consumption and pollution in the environment. With the upcoming future innovation of using electric vehicles, hybrid in the means of transportation will have a major effect on reducing the transportation cost, also they are much more reliable and safe transport in comparison. The transport Industry has seen a change in tax rate from 15% in the indirect tax structure to 18% in the current GST regime. Generally, the transport industry will be facing some fluctuations in the financial numbers which will impact the producers. Over the coming years, auto component manufacturers need to adopt the technology for better opportunities in future which will take place by the means of research and development.

Considering the import and exports of the auto component industry, under Goods and services Tax the rate on exported goods has decreased as it will allow the domestic producers to grow and globalize their products. And about the imports, the taxes have been increased so to provide confidence to the domestic manufacturers and to develop the customer base/market.

In the GST structure, a major loophole that is eliminated in the auto component industry is to ease the problem of auto original equipment manufacturers (OEM’s) to set up their manufacturing units and warehouses at the best option suitable to them. In the present GST Structure, there is no need to set up the unit near to the automobile manufacturers as the input tax credit claim will be available through SGST and IGST to them on the supplies of goods and services for which they paid tax on inputs. It has become easier to set up units in lower investment cost as the place of investments will be the one where auto component manufacturers want to establish and can utilize the working capital more efficiently.

Suggestions

The Goods and Services Tax is still a challenge for the automotive industry, especially when it comes to the auto component industry which acts as a backbone to the automobile Industry by supplying all the components needed to assemble a vehicle. Due to the procedure of Online submission of GST returns, it becomes mandatory for the auto component industries to employ skilled accountants who has a complete knowledge regarding the returns submission with the efficiency of completing and maintaining the record of the returns to be submitted officially to the GST portal.

After GST implementation, the tax rate for auto components has been fixed to 18 % which has helped the industry to grow when compared to the earlier tax rate of 18-20%. With this advantage, auto original equipment manufacturers should expand their business by contacting the automobile industries as they want the high quality standard products only because of the market reputation (Capitalization) they have created from past many years.

Also, Time management plays a major role in the present Goods and services tax when we consider the submission of GST returns by the company officials working on maintaining the records. Auto component manufacturers and the suppliers supplying the materials to manufacture components are filing late returns because of which they are facing issues in the credit of Input tax i.e. the delay in claiming the ITC. To improve the mechanism, manufacturers and their suppliers should develop a proper procedure and schedule of timely submission for the claim of ITC. They should be given proper training by the top management officials or from the experts who are professional in the procedure of maintain and filing returns.One of the major problem that exists now in the auto component industry is by the side of the Government in terms of inclusion of components under Input tax credit Claim. According to the government and the auto original equipment manufacturers, presently 60% of the auto components are registered under ITC claim but 40% of the components are still not registered which makes difficult for the manufacturers to produce the unregistered components. Auto original equipment manufacturers (OEM’s) producing unregistered auto components increases the production cost for the business which decreases the profitability of the company ultimately slowing down the growth of the business.

To increase the efficiency of the Auto component industry, each and every auto component manufacturing industry should use SAP software when it comes to maintaining of the accurate inventory level or the inventory level management and the preparation of the financial statements. The accurate financial statements are prepared when the inward and the outward supplies of the company are recorded in a proper way as it is filed accordingly to the GST portal.

References

Anil Kumar Bhuyan, R. N. (December,2017). GST A NEW TAX REFORMS IN INDIA- IMPLEMENTING TOWARDS SUSTAINABLE DEVELOPMENT OF THE ECONOMY. IJCRT.

Auto components Industry in India. (2018, October). Retrieved from Indian Brand Equity Foundation: https://www.ibef.org/industry/autocomponents-india.aspx

AUTOMOBILES SECTOR. International Journal of Research in Business Management (IMPACT: IJRBM) , 115-120.

Bhattacharya, G. (November 2017). Evaluation and implementation of GST in Indian growth: A study. International Journal of Commerce and Management Research, 65-68.

Business Information. (n.d.). Business Financing. Retrieved from Business Information: https://www.bostonapartments.com/loans/business/businessfinance/business-financing.html

Clear Tax. (2018, July 2). E-way Bill Validity. Retrieved from Clear Tax: https://cleartax.in/s/gst-eway-bill-validity-distance

Dhingra, B. (n.d.). ANALYZING THE IMPACT OF GST ON THE AUTOMOBILE SECTOR IN INDIA. Retrieved from coinmen: http://www.coinmen.in/en/blog/analyzing-the-impact-of-gst-on-the- automobile- sector-in-india/ Business and Management (IOSR-JBM) , 63.

Equitymaster. (March 26,2018). Auto Ancillaries sector analysis. Equitymaster. K.Neelavathi, M. R. (2016). Impact of GST on Automobile Industry. IOSR Journal of

Garg, G. (2014). Basic Concepts and Features of Good and Service Tax In India. International Journal of scientific research and management (IJSRM) , 542- 549.

India Brand equity Foundation. (2018, October). Auto Component Industry In India.

India Brand Equity Foundation. (n.d.). Auto Components.

J.S, S. B. (2010). Indian Auto Component Industry: Challenges Ahead. International Journal of Economics and Business Modeling , 01-11.

J.S., S. B. (n.d.). Indian Auto Component Industry: Challenges Ahead. International Journal of Economics and Business Modeling , Jan 1, 2011.

Jose, T. (2017, July 7). Input tax Credit. Retrieved from Indian Economy.net: https://www.indianeconomy.net/splclassroom/what-is-input-tax-credit-itc- under-gst/

Jose, T. (2017, July 7). Input Tax Credit. Retrieved from Indian Economy.net: https://www.indianeconomy.net/splclassroom/what-is-input-tax-credit-itc- under-gst/

Jose, T. (2017, July 7). What is Input Tax Credit under GST? Retrieved from Indian Economy.net: https://www.indianeconomy.net/splclassroom/what-is-input- tax-credit-itc-under-gst/

Kumawat, S. (2018, January 22). GST Impact on Automobile and Spare Parts Industry in India . Retrieved from SAG Infotech official Blog: https://blog.saginfotech.com/gst-impact-on-automobile-industry-in-india

News desk - Industry Dynamics, Manufacturing. (2017, June 30). Impact of GST on Auto component manufacturer. Retrieved from SME Venture: https://www.smeventure.com/impact-gst-auto-component-manufacturers/

News desk, Industry dynamics, Manufacturing. (2017, June 30). Impact of GST on Auto component manufacturers. Retrieved from SME VENTURE: https://www.smeventure.com/impact-gst-auto-component-manufacturers/

Saurabh Gupta, S. k. (May,2017). Good and Service Tax: An International Comparative Analysis. International Journal of Research in Finance and Marketing (IJRFM), 29-38.

Singh, H. (2017, October 11). History of Taxation In India. Retrieved from Jagran Josh: https://www.jagranjosh.com/general-knowledge/history-of-taxation-in- india-1481028305-1

Suraj M. Shah, D. N. (February 2017). TAX REFORM FOR DEVELOPING VIABLE AND SUSTAINABLE TAX SYSTEMS IN INDIA WITH

Vasanthagopal, D. R. (April 2011). GST in India: A Big Leap in the Indirect Taxation System. International Journal of Trade, Economics and Finance.

About Anubha Srivastava

Anubha Srivastava is a proven academician, keynote speaker, and corporate trainer with over 13 years of experience in India, Indonesia, and Africa. Currently a Consultant for PT. DJerapah Magah Plasindha and a Visiting Faculty at Universitas Diponegoro and UNNES in Indonesia, she has played pivotal roles in academic and training initiatives such as the Pan Africa e-network project. With an illustrious academic background from institutions like Harvard Business Schoolx and Amity University, she has shared her expertise with entities like TATA Motors, NTPC, and the Indian Army. Additionally, she has published over 28 research papers in reputable journals, served as an editor and peer reviewer for acclaimed publications, and been a keynote speaker at international conferences.

Disclaimer : The opinions expressed in this article are the personal opinions of the author. The facts and opinions appearing in the article do not reflect the views of Indiastat and Indiastat does not assume any responsibility or liability for the same.